Focus Fonds

![[Background image] [CI] Blue sky and buildings](https://carmignac.imgix.net/uploads/article/0001/05/CI_WEB.jpg?auto=format%2Ccompress)

Carmignac Investissement: Q2 2020 overview

Carmignac Investissement had a strong first half of 2020, generating 8.0% of absolute year-to-date performance, while the reference indicator lost 6.3%, resulting in relative outperformance of 14.3%.1

What happened?

The year to June 30th was dominated by the global dislocation caused by the COVID crisis, which began to be reflected in markets in late February when it became clear the virus was spreading outside of China.

![[Insights] 2020 07_FF_Fund_CI (Pro) 1](https://carmignac.imgix.net/uploads/article/0001/12/6f48ee1090a227ea5c654178020ab503fecaa48b.jpeg?auto=format%2Ccompress)

"In the sharp market downdraft of March it was imperative to have a portfolio of high conviction positions so as not to capitulate to the market volatility."

Indeed, our core positions proved extremely resilient to a global economic stoppage – consumers and enterprises simply did not stop adopting the powerful trends of e-commerce, digital payments, cloud-based software, and streamed entertainment.

Moreover, as the world adjusted to quarantine and “Work from Home/Stay at Home” dynamics, many of these adoption curves were vastly steepened, pulling forward penetration rates and profits into the near term. A great example of this is US e-commerce penetration of total retail, which took 8 years to move from 5% to 15%, but only 2 months during the height of the COVID crisis to move from 15% to 25%. Our view is that these penetration rates could be maintained as global economies re-open and continue to higher levels over time.

The powerful responses of governmental and central bank stimulus in the face of this global crisis should not be underestimated. The rapid expansion of the US Federal Reserve balance sheet from $5.2Trn to $7Trn in the second quarter forced government rates and corporate spreads lower and fuelled record US debt and equity issuance.

Aggressive deficit spending by US and European governments served to support consumer activity in the face of unemployment spikes – leading to US consumer purchasing power surprisingly higher at mid-2020 than it was in 2019. However, these measures will have to normalize over time, and the world will need a scientific solution in the form of an effective vaccine before economic activity can sustainably recover to prior levels.

How did we manage the Fund?

While we have confidence in science, and expect a vaccine in the 2021 timeframe, we believe that the recovery will more resemble a “check mark” rather than a “V” in shape. We have thus continued to focus the portfolio on secular growth companies that are not dependent on a strong economic recovery, and that perform well in the low interest rate environment that we see continuing for the medium term. We generally find these companies in the focus sectors that we have built our investment team around: technology, healthcare, consumer and Fintech.

While earnings valuations have expanded somewhat from pre-COVID levels in the Technology/Internet sector, we believe this is largely justified in our selected investments by the resilience these companies demonstrated when the world economy came to a halt in March, and the fact that the crisis has only accelerated powerful adoption trends that were key to our prior thesis. Of course, we are always sensitive to the risk/reward of our holdings, and we are very willing to take profits when we believe returns be less favourable.

![[Insights] 2020 07_FF_Fund_CI (Pro) 2](https://carmignac.imgix.net/uploads/article/0001/12/7ede6b620236ae60605d2c6f93483dee57ef99c3.jpeg?auto=format%2Ccompress)

On a sector basis, the Fund’s portfolio saw first half 2020 gains mainly from the Consumer Discretionary, Technology, Communications Services, and Healthcare sectors. Returns in Consumer Discretionary were dominated by significant e-commerce positions in Amazon and JD.com, which were notable beneficiaries of the COVID crisis.

Technology returns benefited from digital payment investments in Paypal and Adyen, as well as software investments in Elastic, Salesforce.com and Kingsoft Cloud.

Our performance in Communications Services was led by positions in Sea Ltd, Facebook, Nintendo and Tencent, and our Healthcare performance was led by three Chinese positions: Zhifei Biologics, Wuxi Biologics, and Ping An Healthcare. Sector losses were led by relatively small positions in Indian and Italian banks, where we had positive company specific views but were caught in the COVID-related selloff.

"As we enter the second half of 2020, we believe that we are likely to remain in a low growth environment as we recover from COVID headwinds, and thus that secular growth is preferable"

We continue to search for investment ideas where we feel we can formulate a differentiated view from the consensus. The geographic location where exposure remains elevated for the fund is China, where we had doubled exposure entering 2020 to 14% of the portfolio. Our investments in China remain focused on the same themes we have been expressing globally across the portfolio, namely Technology, Consumer Internet, and Healthcare. We note that our Chinese exposure is focused on the domestic market, not companies dependent on US technology or export markets.

Over the extreme market dislocation in March/April we constructed a portfolio of differentiated companies that we believe will outperform as we move closer to a reopening of global economies, especially for the travel space. These include air ticketing and hospitality provider Amadeus, Spanish airport concession AENA, auto semiconductor manufacturer NXP, and US gymnasium chain Planet Fitness. We also added to aircraft engine manufacturer Safran and online travel portal Bookings.com around this theme.

As mentioned above our Emerging Markets exposure is focused on our areas of core competency in China. Our largest position remains Chinese e-commerce platform JD.com, which is a pure play on domestic secular trends and is poised to leverage years of investment in its logistics platform. We are enthused by Chinese healthcare trends and have focused on Wuxi Biologics, Zhifei Vaccines and Ping An Health in that sector. In Chinese Internet Infrastructure we added Kingsoft Cloud in its IPO to our existing position in data centre provider GDS. We exited digital listings provider 58.com (WUBA) as it announced a “take private” transaction.

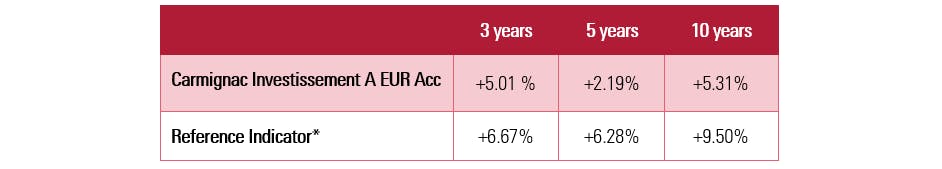

Source: From 01/01/2013 the equity index reference indicators are calculated net dividends reinvested. *Reference indicator: MSCI ACWI (USD) (Reinvested net dividends), Carmignac, 30/06/2020. Past performance is not a reliable indicator of future performance. Performance may change as a result of currency fluctuations.

Carmignac Investissement

Main risks of the Fund:

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

![[Scale risk] 5/5 years_EN](https://carmignac.imgix.net/uploads/article/0001/11/199a1a143646260738130c0161effc4de2cf6342.png?auto=format%2Ccompress)

*Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time.

Source: Carmignac, 30/06/2020<

1 Performance of the A EUR acc share class. Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations. Performances are net of fees (excluding possible entrance fees charged by the distributor). Reference indicator: MSCI ACWI (USD) (Reinvested net dividends). From 01/01/2013 the equity index reference indicators are calculated net dividends reinvested.