Changes to the Carmignac Investissement Latitude Fund

Letter to holders of the Fund Carmignac Investissement Latitude

Dear Sir/Madam,

We would like to thank you for the trust you have placed in us. We are honoured to count you among the unitholders of the Carmignac Investissement Latitude fund (the “Fund”), a feeder fund of Carmignac Investissement. We are writing to inform you of a number of changes regarding your Fund.

1. What changes are being made to the Fund?

From 30 December 2024, the Fund will no longer invest in the X EUR Acc units of Carmignac Investissement, its master fund, but in the Z EUR Acc units instead. This change will have no effect on the Fund’s strategy, with at least 85% of its portfolio continuing to be invested in its master fund and, on an ancillary basis, in cash.

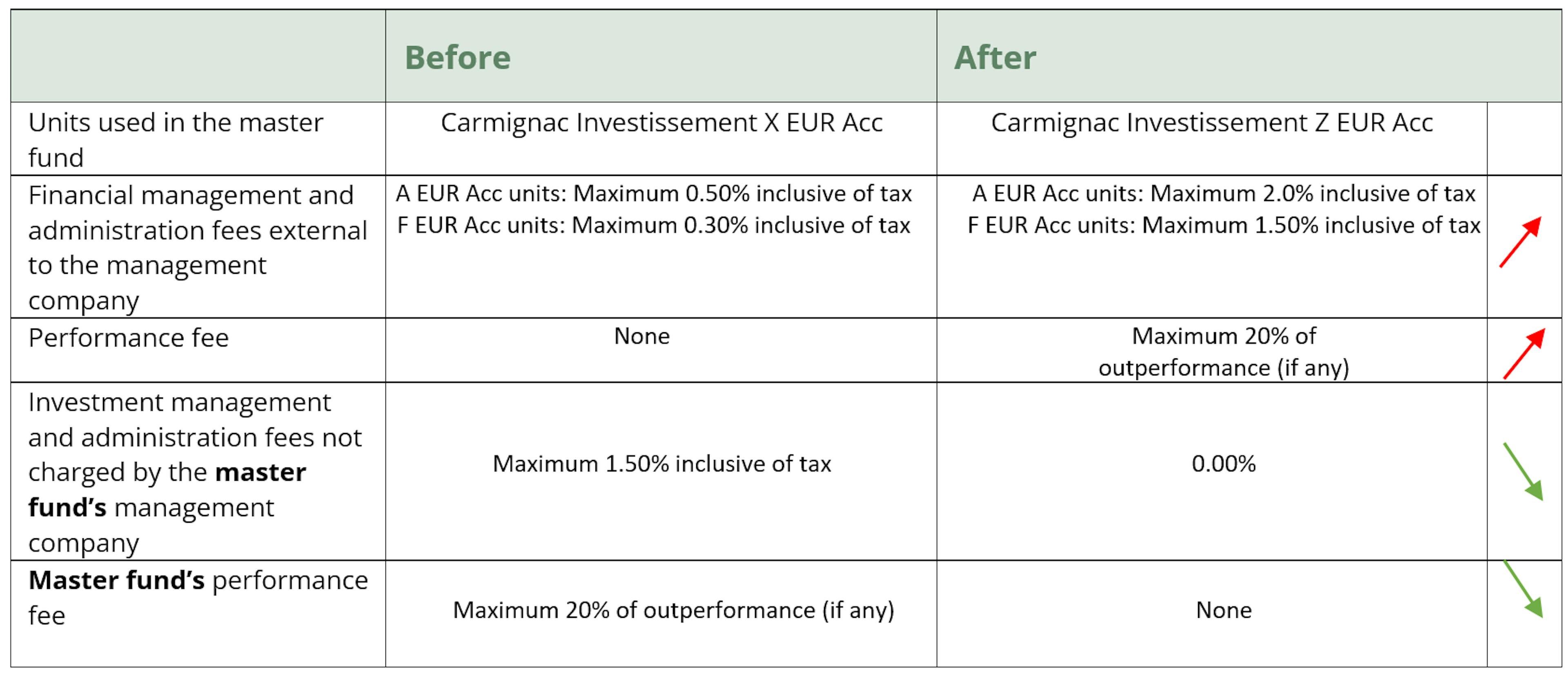

The management company has altered the Fund's fee structure accordingly – see the summary table in point 5 below for details.

These changes will have no impact on the methods used to select financial instruments and will not result in any change to the risk scale or the risk/return profile of the Fund.

2. When will these changes take effect?

The changes will take effect on 30 December 2024.

3. What impact will these changes have on the risk/return profile of your investment?

The changes will take effect on 30 December 2024.

- Change in risk/return profile: No

- Increase in risk profile: No

- Potential increase in fees: Yes

- Extent of change in risk/return profile: Not significant

4. How does this change affect your tax situation?

These changes will have no impact on the tax situation of unit holders.

5. What are the main differences between the Fund in which you currently hold units and the future Fund?

6. Key points to remember

This document is important and requires your attention. If in doubt, please contact your usual advisor.

Please note the importance of reading the Key Information Document (KID). Your usual advisor is available should you require any further information.

The prospectus and key information documents, as well as the latest annual and semi-annual reports, are available in French, English, German, Italian, Spanish and Dutch free of charge from the registered office of the Fund management company: CARMIGNAC GESTION, Société anonyme (public limited company), 24 Place Vendôme, 75001 Paris, France. They are also available at www.carmignac.com and from the management company’s representative in Switzerland: CACEIS (Switzerland) SA, Route de Signy 35, CH-1260 Nyon. The Swiss Paying Agent is CACEIS Bank, Paris, Nyon/Switzerland branch, Route de Signy 35, 1260 Nyon.

The net asset values are published on www.carmignac.com and www.fundinfo.com.

Yours faithfully,

Christophe Peronin

Deputy Managing Director

Related articles

Changes to the prospectus of Carmignac Portfolio