The increasing influence of Emerging Markets

Emerging Markets: Shaping the world of tomorrow

Since the early 1980s, the composition of Emerging Markets has changed more than any other investment universe. Rising living standards, an expanding middle class, more open financial markets, changing consumption habits and urbanisation are some of the many features which make Emerging Markets such a fertile hunting ground for investors seeking growth.

The evolution of Emerging Markets

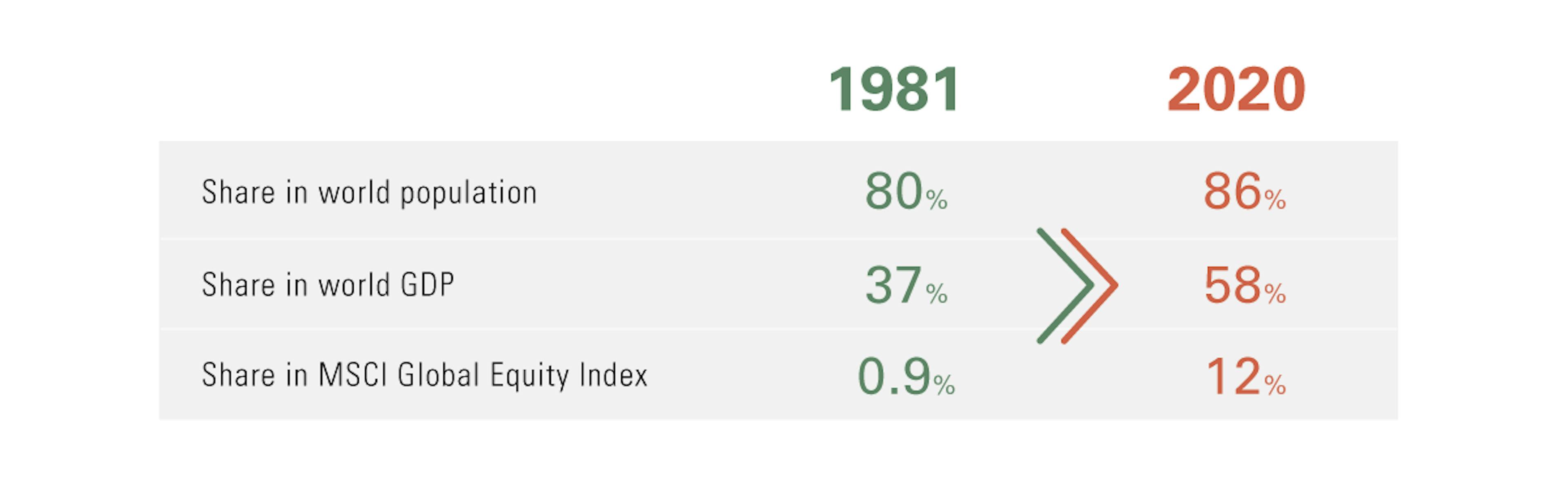

Four decades ago, Emerging Market countries represented 80% of the world’s total population. But while the share of the global population remains relatively the same, over the same period, their economic and financial influence has grown dramatically: they now generate 58% of the world’s Gross Domestic Product (GDP) and this share is expected to continue rising1.

Of course, no two countries are the same, and the fortune of each Emerging Market country has fluctuated over time. For example:

- In 2000, South Africa was considered the biggest Emerging Market country, and had a 16% weighting in the MSCI EM index. Today South Africa’s index weighting has shrunk to 0.6%2 .

- China continues to demonstrate outstanding growth: its contribution to total world GDP has increased from 2% to 18% in just 30 years3 and it now represents 41% of the MSCI EM index4 .

Having invested in Emerging Markets from our inception in 1989, we know the twists and turns, and highs and lows of this universe. We have always believed in the growth potential, regardless of the global backdrop, and we have upheld the courage of our conviction even through times when others found the investment case much harder to see.

Ample room to grow

Investors now see Emerging Markets as more than just a cyclical play.

One of the key criticisms faced by Emerging Market economies is that they remain too heavily dependent on exporting commodities (the most notable examples being Russia and Saudi Arabia), which makes them highly cyclical in nature. But for most countries, their continued economic development involves structural long-term reforms that truly diversify their economies.

Emerging Markets are now outperforming Developed Markets after a decade of underperformance.

Today, the Emerging Market universe is mainly driven by North-east Asia, which has had more success than the rest of the world in handling the COVID pandemic. Some Asian countries even managed to grow their economies during 2020. It’s also worth noting that they were able to achieve this superior growth while implementing significantly smaller stimulus programmes6 meaning the quality of the growth delivered was superior.

Did you know?

In 2020, China and Vietnam posted annual GDP growth of 1.9% and 1.6% respectively, an impressive feat considering GDP fell 4.3% for the United States and 7.6% for the European Union7.Overall, macroeconomic fundamentals have improved for many Emerging Market countries.

Many have seen their current account balances shift from deficit to surplus, like Brazil. As economies gradually open up and vaccination campaigns progress, we think this positive trend is set to continue. We are therefore increasingly optimistic about the prospects for Emerging Markets in 2021 and beyond.

Related articles

Carmignac Portfolio Emergents: Letter from the Fund Manager