3rd quarter 2023: Our active stewardship illustrated

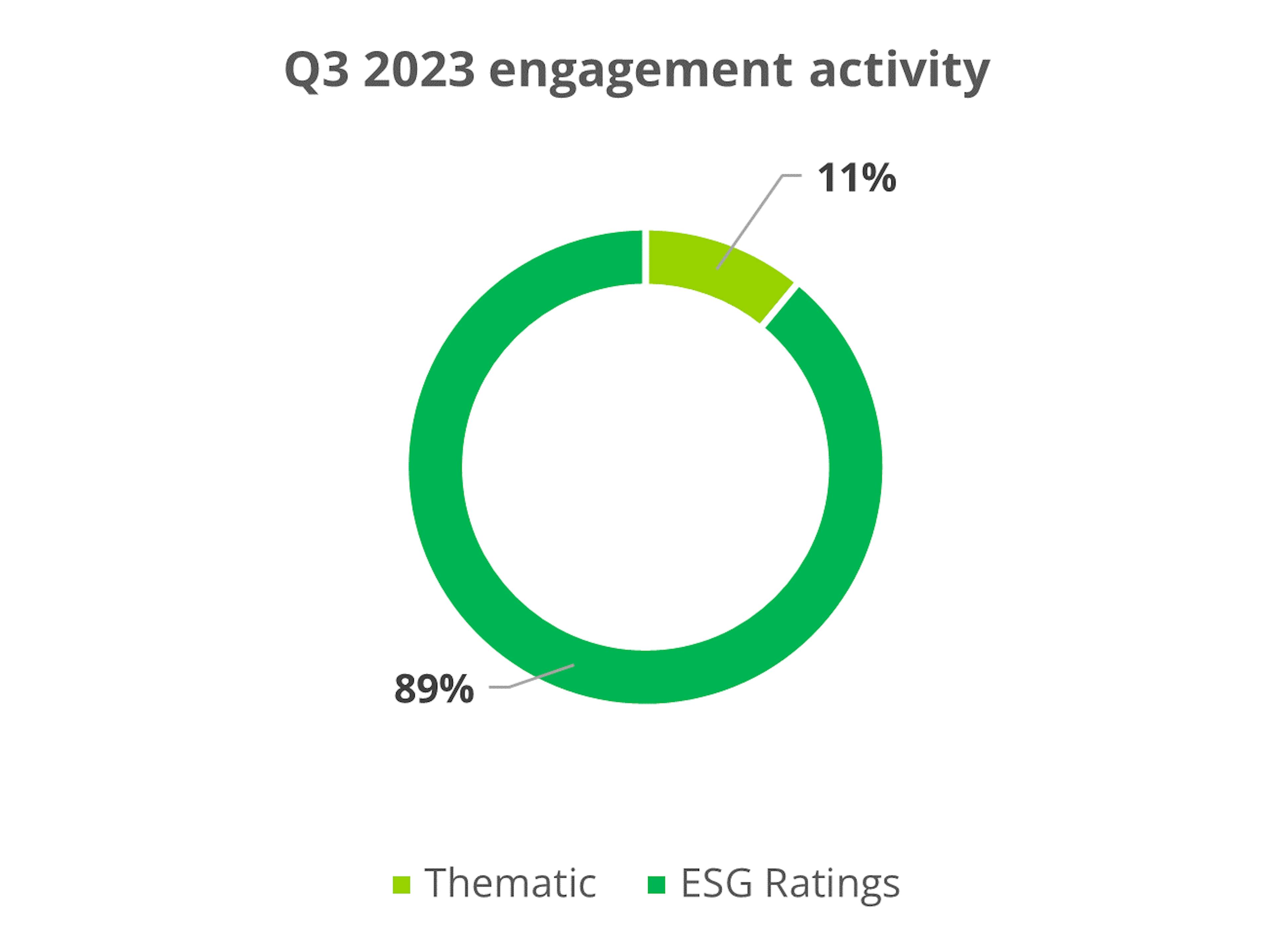

As a long-term investor, we engage in regular dialogue with the companies in which we invest to encourage them to improve their practices for taking environmental, social and governance (ESG) criteria into account. Find out how our active approach to stewardship was borne out in the third quarter 2023:

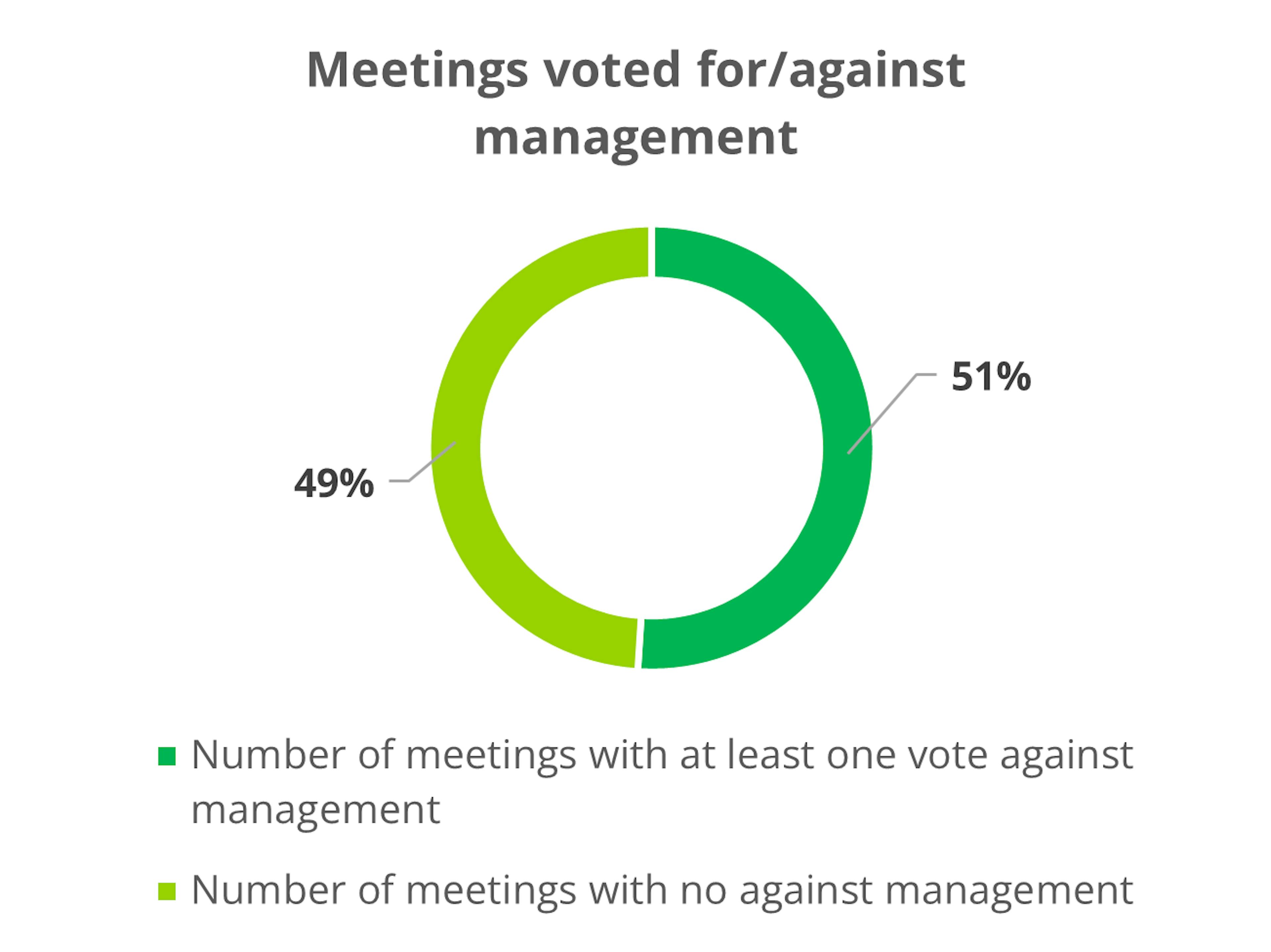

*This data refers to the number of meetings where Carmignac took a vote position against the recommendation of the board. In practice, this refers to votes cast against management-led resolutions and, in most cases, votes cast for shareholder-led resolutions (unless the shareholder-led resolution is supported by management).

Carmignac is committed to aligning its dialogue strategy with five types of engagement: engagement on ESG ratings, thematic engagement, impact engagement, engagement on controversial behaviour, and engagement on proxy voting decisions1.

Find out how we specifically engaged with two investee companies during the third quarter 2023:

COCA-COLA ICECEK (CCI)

Sector: Consumer staples

Region: Middle East

Through managed portfolios, Carmignac holds1 a bond linked to ESG constraints (Sustainability-Linked Bond or SLB) issued by CCI.

L’Oréal

Sector: Consumer staples

Region: Europe

Carmignac is an equity investor in the company3.

2The proprietary ESG system START combines and aggregates market leading data providers ESG indicators. Given the lack of standardisation and reporting of some ESG indicators by public companies, not all relevant indicators can be taken into consideration. START provides a centralised system whereby Carmignac’s proprietary analysis and insights related to each company are expressed, irrespective of the aggregated external data should it be incomplete. For more information, please refer to our website.

3As of 30th September 2023: Carmignac Absolute Return Europe, Carmignac Alts ICAV-European Long Short, Carmignac Global Active, Carmignac Investissement, Carmignac Investissement Latitude, Carmignac Patrimoine, Carmignac Portfolio Evolution, Carmignac Portfolio Family Governed, Carmignac Portfolio Flexible Allocation 2024, Carmignac Portfolio GrandChildren, Carmignac Portfolio Grande Europe, Carmignac Portfolio Human Experience, Carmignac Portfolio Investissement, Carmignac Portfolio, Patrimoine, Carmignac Portfolio Patrimoine Europe, Carmignac Profil Réactif 100, Carmignac Profil Réactif 50, Carmignac Profil Réactif 75, FP Carmignac European Leaders, FP Carmignac Global Equity Compounders, FP Carmignac Patrimoine.

To find out more on our responsible investment philosophy, please visit our Sustainable Investment section:

Sustainable InvestmentRelated articles

CLOs - the new frontier of ESG integration in fixed income markets

Carmignac’s Article 9 funds: a sustainable investment?

Carmignac receives the ‘Label ISR’ for five additional funds

Marketing Communication. This document is intended for professional clients.

This communication is published by Carmignac Gestion S.A., a portfolio management company approved by the Autorité des Marchés Financiers (AMF) in France, and its Luxembourg subsidiary Carmignac Gestion Luxembourg, S.A., an investment fund management company approved by the Commission de Surveillance du Secteur Financier (CSSF). “Carmignac” is a registered trademark. “Investing in your Interest” is a slogan associated with the Carmignac trademark. This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. Copyright: The data published in this presentation are the exclusive property of their owners, as mentioned on each page. UK: This document was prepared by Carmignac Gestion and/or Carmignac Gestion Luxembourg and is being distributed in the UK by Carmignac Gestion Luxembourg UK Branch (Registered in England and Wales with number FC031103, CSSF agreement of 10/06/2013). CARMIGNAC GESTION 24, place Vendôme - F-75001 Paris - Tél : (+33) 01 42 86 53 35 Investment management company approved by the AMF. Public limited company with share capital of € 15,000,000 - RCS Paris B 349 501 676 CARMIGNAC GESTION Luxembourg - City Link - 7, rue de la Chapelle - L-1325 Luxembourg - Tel : (+352) 46 70 60 1 Subsidiary of Carmignac Gestion - Investment fund management company approved by the CSSF Public limited company with share capital of € 23,000,000 - RC Luxembourg B 67 549.