Quarterly Report

![[Background image] [CI] Blue sky and buildings [Background image] [CI] Blue sky and buildings](https://carmignac.imgix.net/uploads/article/0001/05/CI_WEB.jpg?auto=format%2Ccompress)

Carmignac Investissement : Letter from the Fund Manager

Carmignac Investissement lost -3.48%* in the third quarter of 2021 vs +1.25% for the reference indicator1. Since David Older’s took over the management2, the Fund is up 78.17% vs 61.31% for its indicator.

-

-3.48%Carmignac Investissement’s performance

in the 3rd quarter of 2021 for the A EUR Share class.

-

+1.25%Reference indicator’s performance

in the 3rd quarter of 2021 for MSCI World.

-

+78.17%Since David Older took over the management

vs 61.31% for the reference indicator.

Quarterly Performance Review

Equity markets recorded mixed performance over the quarter. In developed countries, the positive momentum driven by robust Covid-related fiscal and monetary stimulus and strong earnings growth stopped in September. Rising inflationary pressures and the perspective of a slowing pace of growth post-Covid have weighed on investors’ enthusiasm. In the emerging world, the Chinese government’s announcements of stiffer regulation of several sectors led to a market selloff. In this context, sector and geographic performances differed, with developed market financials, materials and energy leading the move.

While they clearly drove our outperformance in 2020, our Chinese positions led us to underperform this quarter and in 2021 to date. We believe we have built an expertise in finding secular growth companies over the years and had significant exposure to the region, which overflows with high growth opportunities. However, news flow over recent months has negatively impacted investor sentiment. The Chinese government has announced new initiatives and regulations with the aim of fostering “social prosperity” in the broad sense. Some examples would be probing the monopolistic behavior of the biggest Internet platforms, protecting consumer data security, and ensuring fair wages/benefits for temporary workers engaged in e-commerce and food delivery or ride sharing. While the initiatives appear rational, the market sold off on the lack of clarity as to how the changes would affect business models. On the top of these regulatory measures, a potential default of Evergrande, a large Chinese property developer, raised fears about potential contagion to other parts of the economy. All of this considerably weighed on Chinese equities over the quarter.

Despite weakness in our Chinese exposure, other high convictions positions recorded good performance, like the cloud-based software company Salesforce, now the biggest position in our book. The company is emblematic of the secular growth companies that we look for. It has exposure to multiple aspects of the digital transformation that we are seeing across geographies and industries today, with a large total addressable market close to $175Bn as well as historically strong and sustainable earnings3. Cybersecurity company SentinelOne also contributed nicely. Organizations have faced new security challenges as the cloud and remote working have become a must. Many cybersecurity values have skyrocketed as a result, and the demand for next-generation security software in a new digital age is higher than ever. Global spending on cybersecurity is expected to exceed $120 billion by year-end and continues to be a high-growth sector in the future. We have sold our position in SentinelOne after very strong returns but bought US cybersecurity company Palo Alto Networks to retain exposure to this important thematic. Some of our top positions like Microsoft and Alphabet also recorded a positive performance.

Outlook

Our investment process revolves around identifying sustainable companies underpinned by powerful secular growth trends in order to invest in companies that can perform in different economic conditions. This allows us to build strong convictions that can outperform over the long term, and to avoid secularly challenged businesses that fail to offer long term attractive and visible growth.

As long-term investors, we see the sell-off in Chinese equities as creating good opportunities and attractive entry points. In fact, clearer regulation for big companies should be long term constructive for Chinese markets as it provides investors with more visibility on business models and improves corporate governance standards. However, selectivity prevails. We mostly focus on segments where a negative scenario has been priced in that we feel is not justified, and those where we see minimal government risk or outright government support towards the creation of Chinese champions – for example in drug development, technology or renewable energy.

For the coming months, we should expect weaker economic growth momentum due to lesser fiscal impulse and tightening monetary policies. This should result in headwinds to the earnings growth of the overall market - which we expect to favor companies benefiting from more visibility and structural themes. However, as inflationary pressures are rising, stock selection could become again key to make a difference even within the growth trend.

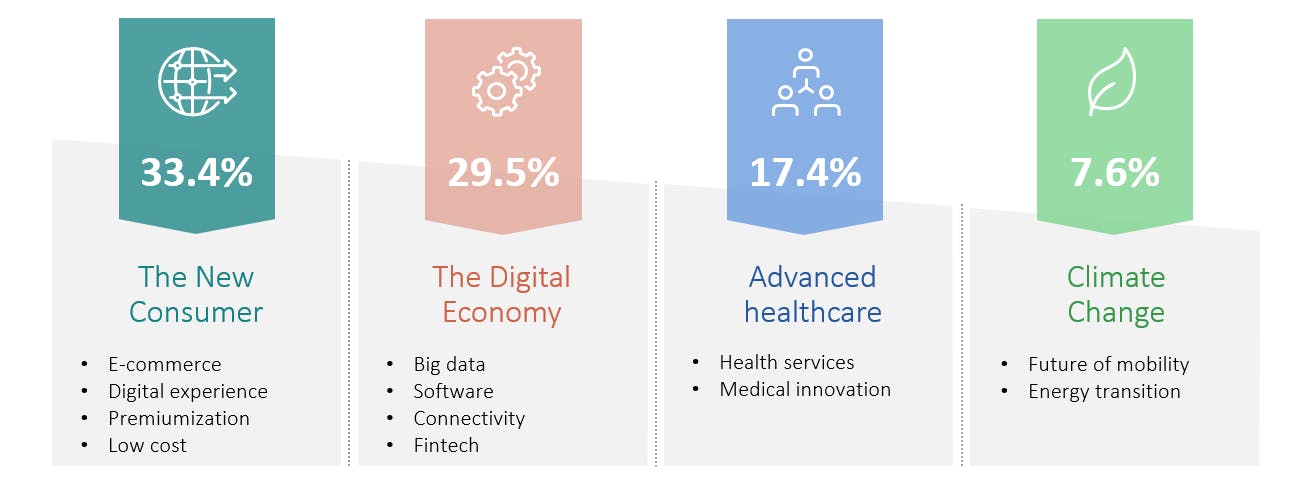

As a result, we maintain a liquid portfolio, diversified in terms of geography, sectors and themes. Our core thematics revolve around 1) the New Consumer (33%), with ecommerce players like China’s JD.com and Amazon, sportswear brands Lululemon and Puma, and luxury company Hermes 2) the Digital Economy (30%), with fintech names like Square and Affirm, and software companies Salesforce and Kingsoft Cloud, and transport and meal delivery platform Uber 3) Advanced Healthcare (17%), with names like China’s Wuxi Biologics and the American health provider Anthem, and 4) Climate change (6%) with Korean battery producer LG Chem and US residential solar provider SunRun.

The pandemic has served as an accelerator of existing trends. Online shopping, food delivery, digital payments, flexible work technology, and cloud-based infrastructure are not new, but the COVID crisis has vastly accelerated their adoption. Companies positioned to ride these trends are not only disrupting incumbents but extending their leads on their peers. These are the companies we are investing in.

Source: Carmignac, 30/09/2021. Others: 6.3%. Portfolio composition can change over time and without prior notice

(1) Reference Indicator: MSCI ACWI (USD) (net dividends reinvested).

(2) 31/12/2018

(3) Source: Bloomberg

Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged. Performances are net of fees (excluding possible entrance fees charged by the distributor).

As of 01/01/2013, the reference indicators for the shares are calculated net dividends reinvested. Source: Carmignac, 30/09/2021

Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Carmignac Investissement A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

Carmignac Investissement A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Investissement A EUR Acc | +10.39 % | +1.29 % | +2.13 % | +4.76 % | -14.17 % | +24.75 % | +33.65 % | +3.97 % | -18.33 % | +18.92 % | +15.17 % |

| Reference Indicator | +18.61 % | +8.76 % | +11.09 % | +8.89 % | -4.85 % | +28.93 % | +6.65 % | +27.54 % | -13.01 % | +18.06 % | +10.79 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Investissement A EUR Acc | +3.24 % | +11.20 % | +7.30 % |

| Reference Indicator | +9.36 % | +12.25 % | +10.89 % |

Scroll right to see full table

Source: Carmignac at 31/05/2024

| Entry costs : | 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,50% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 1,09% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |