Flash Note

Equity strategy by David Older: Don’t forget the big picture!

Identifying long-term investment trends under-appreciated by consensus is a distinctive feature of our global equity management

A preference for growth stocks, benefiting from robust trends

For 2020, beside managing the Beta, our core approach to achieving returns still rests on generating alpha in the equity markets. We therefore feel that our strategic preference for growth stocks, benefiting from robust trends, is in no way an empty, common-sense boilerplate. In fact, identifying long-term investment trends under-appreciated by consensus is a distinctive feature of our global equity management. Indeed, we believe the ability to understand and identify disruptive trends are today the key to create successful long-term investment strategies.

Four thematics to keep in mind

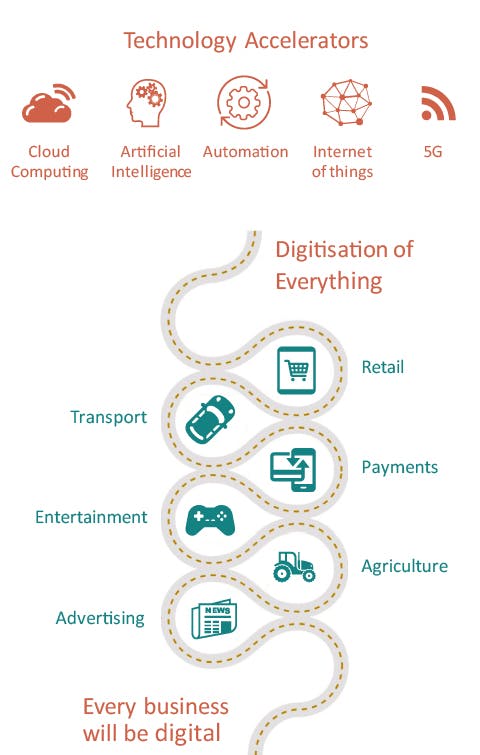

Digitisation

In 2019, the world spent roughly 5% of global GDP on technology. By 2030, this is expected to double to more than 10% of GDP 1. Driving this progression is a broad trend calls the “digitisation of everything”. Every business on earth is in the midst of a digital transformation that will lead to greater productivity and operating efficiencies.

Demographic & social changes

Middle class explosion, aging population, urbanization, rich becoming richer, millennials taking over, shrinking household size are all factors that disrupt consumption & health care sectors leaving room for multiple investment opportunities.

Connected consumer

Today’s empowered consumers have knowledge, choice, and high expectations of companies they choose to do business with, emphasizing the importance of choosing the right stocks in this disruptive universe. The segments affected by this revolution include ecommerce and video games among others.

Renewable energies

Renewable energy is one of the most significant megatrends impacting economies around the globe today. Renewable energy is entering an era in which growth depends more on market forces and less on policy support. By 2040, we estimate that renewables will represent 50% of energy production compared to 7% in 2018 2. The sector offers viable long-term investment opportunities.